In the early 1980’s most budgeting and analysis was being done on 16 column accounting pads with a pencil and eraser. As we moved through the 80s the first spreadsheets appeared. Slowly but surely a transformation took place that changed…

Read More

Reserve Management: Not the Nightmare Everyone Thinks It Is

While the Vacation Ownership industry has changed and matured over the past generation, a majority of the industry is unaware that the task of reserve management is no longer the expensive or tedious task that it once was. To refresh…

Read More

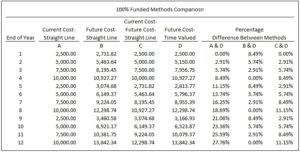

Reserves: No Standards for Calculations or Reporting

After more than two decades of review and re-calculating numbers in reserve studies, it is conclusive that there is a range of different financial results being produced by reserve study companies. At the end of the recent CAI National Conference,…

Read More

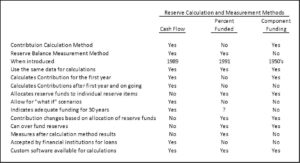

Reserves: A History of An Un-Unified Understanding?

With the introduction of common-interest-developments some 50 plus years ago, came the requirement of Reserves: the long-term maintenance and replacement contribution plan for the common areas. At this time the personal computer and spreadsheets did not exist. Common area reserve…

Read More

RMP: Annual Update Only Takes 10 Minutes?

This is an Annual 10 Minute Update Solution for those avoiding the tedious task of initially producing and annually updating a Reserve Management Plan. This solution/method will still produce the needed support for the annual reserve budget and cash flow…

Read More

Beyond the Reserve Study…

Reserve Studies of some shape or form have been done for over half a century now for many common-interest-developments, timeshare and other types of properties. Prior to that, we surmise in some scenarios, like Mayan culture, Mesopotamia or even Machu…

Read More

Reserve Management Plan – Unit Interiors

Producing a Reserve Management Plan for Vacation Ownership unit interiors is usually a long and tedious exercise that potentially has no end in sight. Usually the easiest way to tackle any exercise is to do the hardest part first. When…

Read More

The Responsibility of HOA Reserve Reporting: Deciphering California Civil Code Article 1365

It is a little known fact that the preparation of a common-interest-development reserve study is not required to be done by a third party, section 1365.5 (e) – “At least once every three years, the board of directors shall cause…

Read More