Legislation – Terms – Interpretations – Opinions

When the common-interest-development (CID) industry was conceived it was probably impossible to foresee problems that might arise from the concept. It was a concept with a simple plan. Create affordable housing with shared common areas and amenities. Instead of paying $500,000 for a house and pay all related expenses (trash, water, gas, electric, landscaping, exterior maintenance and amenities), buy a condominium for $350,000 with tennis courts, pools, Jacuzzi, tot-lot, etc. and pay only your part of the common area ownership (one-hundred units, one-hundredth the cost).

Prior to the 70’s, there were less than 10,000 CIDs compared to over 300,000 today, in the USA alone. As the concept was being formed by trial and error, guidelines began to be established for the building developers. Next question was how would these CIDs operate and be managed? Depending on the state and when the CID was developed, Corporate by Laws and CC&Rs (Covenants, Conditions and Regulations) or state legislation made this determination. It may not have been obvious at the time but operating a CID was going to have two distinct parts:1) current operations, and 2) long-term maintenance and refurbishment. Budgeting for current operations has become a straightforward process which everyone appears to agree on. But budgeting for long-term maintenance and refurbishment has not had this luxury.

For the past 30 years the methods for budgeting long-term maintenance and refurbishment of CIDs has been debated. What has become known as Reserve Studies has generated numerous conceptions and methods for producing a Reserve Plan leaving the board of directors and homeowners confused.

Why all the confusion?

Legislation has been the first problem. There are no federal guidelines on a method or how a Reserve Study should be prepared. At least not yet. Individual states have formed their own guidelines. For example, California was on the forefront with their Department of Real Estate and CID legislative civil codes. This legislation has been adapted and changed many times over the last 25 years. Reserve terms have been developed but their meanings are not always agreed upon. Based on adaption, change and terms, the profile of Reserve Studies has been left open to interpretation. And what follows interpretation? Opinions. When all viewed together, only confusion is produced for the board of directors, owners and the reserve preparers. Here are some of the terms and Reserve funding methods:

- Full Funding Plan – maintain a Reserve balance equal to the deteriorated value of the reserve items

- Baseline Funding Plan – maintain a Reserve balance that never falls below zero

- Threshold Funding Plan – maintain a Reserve balance that never falls below a pre-determined amount

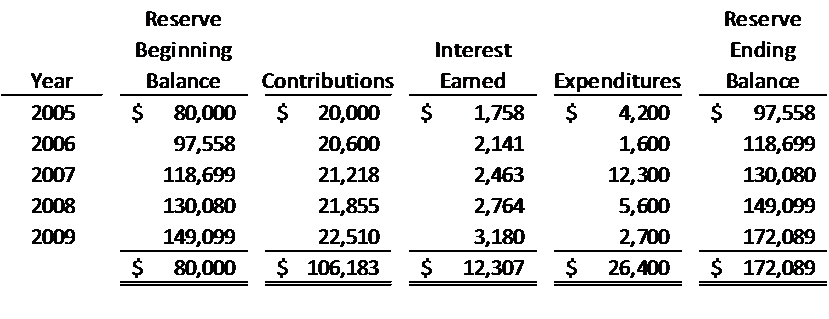

All three of these plans have different objectives and results, but they use the same basic calculation structure: a cash flow projection. The following is the structure of a cash flow projection:

Based on the assumptions used in the cash flow: reserve beginning balance, initial contribution, annual percentage increase to the contribution, interest earned after taxes and inflation on reserve item expenditures, gives title to the reserve funding plan, be it Baseline Funding or Threshold Funding.

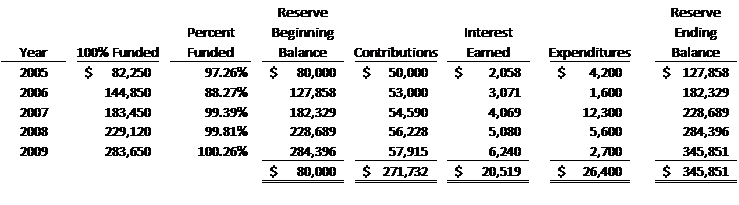

An additional term and calculation must be performed before a Full Funding Plan or 100% Funded can be determined: Percent Funded. The concept of Percent Funded is based on the amount of funds which must be available at a point in time if the Reserve Fund is to be 100% Funded. The straight-line calculation is done as follows: if a reserve item costs $10,000, has an estimated useful life of 10 years and has been in service four years, then $4,000 would have to exist for this reserve item to be 100% Funded. The following is the same cash flow structure compared to 100% Funded:

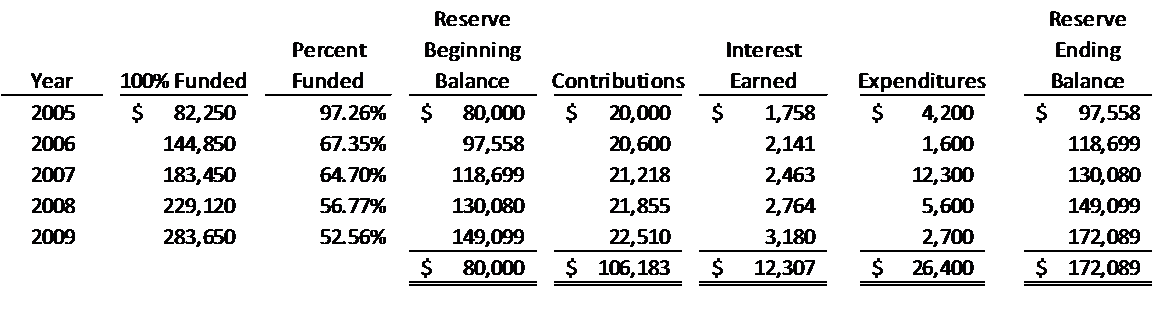

This Full Funding/100% Funded plan presents that the Reserves will be 100% by the year 2009. But this plan needed to increase the initial contribution from $20,000 to $50,000 and the annual percentage increase to the contribution from 3.00% to 6.00% from the previous cash flow. When Percent Funded/100% Funded is applied to the initial cash flow, the Percent Funded is half as much in the year 2009. See the following:

Even though only approximately 50% funded per 100% Funded calculations, there is a positive cash flow projection. The Full Funding/100% Funded plan would call for contributions that would build the Reserve Fund balance to $345,851 compared to the positive cash flow balance of $172,089. The board of directors must set the objectives and policies for their association’s funding plan. The main objective being that reserve funds will be available when needed.

While there are many opinions on how a Reserve Study plan should be calculated and presented, there are other factors that should be considered that are not addressed above. The American Institute of Certified Public Accountants (AICPA) does not recognize Percent Funding in their Audit and Accounting Guide for Common Interest Realty Associations (CIRA) but does defer to state statutes that should be engaged when planning for reserves. The AICPA does not take a position on how a reserve plan should be formulated but that a, “…systematic accumulation of funds is:

- A means of assuring that funds for major repairs and replacement will be available when needed;

- An equitable method of charging current rather the future owners with the cost of the current use of assets;

- A means of preserving the market value of individual units or shares.”

The CIRA Guide goes on to say: “A CIRA should disclose information in its financial statements about it funding for future major repairs and replacements. Disclosures about such funding should include the following:

- Requirements, if any, in statutes or the CIRA’s documents to accumulate funds for future major repairs and replacement and the CIRA’s compliance or lack of compliance with them;

- A description of the CIRA’s funding policy, if any, and compliance with that policy;

- A statement that funds, if any, are being accumulated based on estimated future (or current) costs, that actual expenditures may vary from these estimates, and that the variations may be material;

- Amounts assessed for major repairs and replacements in the current period, if any;

- A statement indicating whether a study was conducted to estimate the remaining useful lives and the costs of future major repairs and replacements

CIRAs that fund future major repairs and replacements by special assessments or borrowing when needs occur should disclose that information.”

An association that does not have sufficient funds has three choices: 1) special assessment, 2) borrow from a financial institution, or 3) a combination of both. Financial institutions lend based on a business plan that provides for the use of the funds borrowed and how those funds will be repaid. The key analysis in the business plan would be to use a reserve study cash flow projection reflecting the assumptions of the plan. Financial institutions do not recognize Percent Funding which is not applied in any other type of business except in the CID industry. Financial institutions will also look at the association’s maintenance fee delinquencies, owner occupancy rates and the market value and debt of individual properties.

There are no condominium or reserve police to assure that board of directors or associations are doing proper reserve planning. The only forces driving the board of directors for proper reserve planning is fiduciary responsibility and potential personal liability if negligence is proven. Due to the current housing and financial institution crisis there could be a self-appointed “New Sheriff in Town” in regard to the requirement of annual Reserve Studies on a national basis. Currently the FHA is proposing new requirements for FHA financing, one them being annual Reserve Studies. Freddie Mac and Fannie Mae are also in the same review process. If government lending agencies have finally recognized that market values can be affected from the lack of proper long-term maintenance and refurbishment, Reserve Studies may become a requirement for individual loan qualifications.

Regardless of what the future will be for the CID industry, Reserve Studies do not have to be confusing. Reserve Studies should be done annually with a large dose of common sense and simplified for everyone’s understanding.